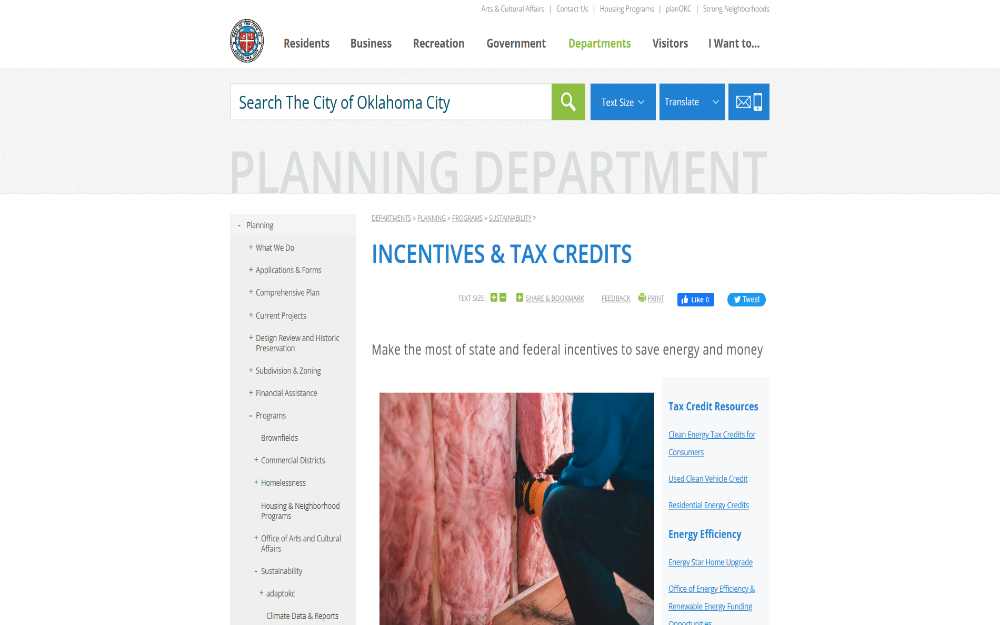

Oklahoma offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Oklahoma Municipal Power Authority

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Oklahoma Government

Office of Governor J. Kevin Stitt

2300 N. Lincoln Blvd., Suite 212

Oklahoma City, OK 73105

(405) 521-2342

[email protected]

Hours: M-F 9:00am – 5:00pm, subject to change

Oklahoma Gas and Electric Company (OG&E)

PO Box 321

Oklahoma City, OK, 73101-0321

Residential Customer Support:

(405) 272-9741

Outages, emergencies, and downed power lines:

(405) 272-9595

Monday – Friday 8 a.m. – 5 p.m.

Oklahoma Secretary of Energy and Environment

204 N. Robinson Suite 1010

Oklahoma City, OK 73102

(405) 522-7099

[email protected]

Hours: M-F 9:00am – 5:00pm, subject to change

Tulsa Weather Bureau

10159 E. 11th St.

Suite 300

Tulsa, OK 74128

(918) 838-7838

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Oklahoma Clean Energy

Renewable Energy

Alternative Fuel Vehicles

Building Code: Energy Efficiency

Wind Power

ChargeOK

Carbon Capture and Geological Sequestration Report (2023)

Contact

Power Outage Map

Department of Environmental Quality

707 N Robinson

Oklahoma City, OK, 73102

(405) 702-0100

Air Quality Division

(405) 702-4157

(405) 702-4173

Solar Energy in Oklahoma

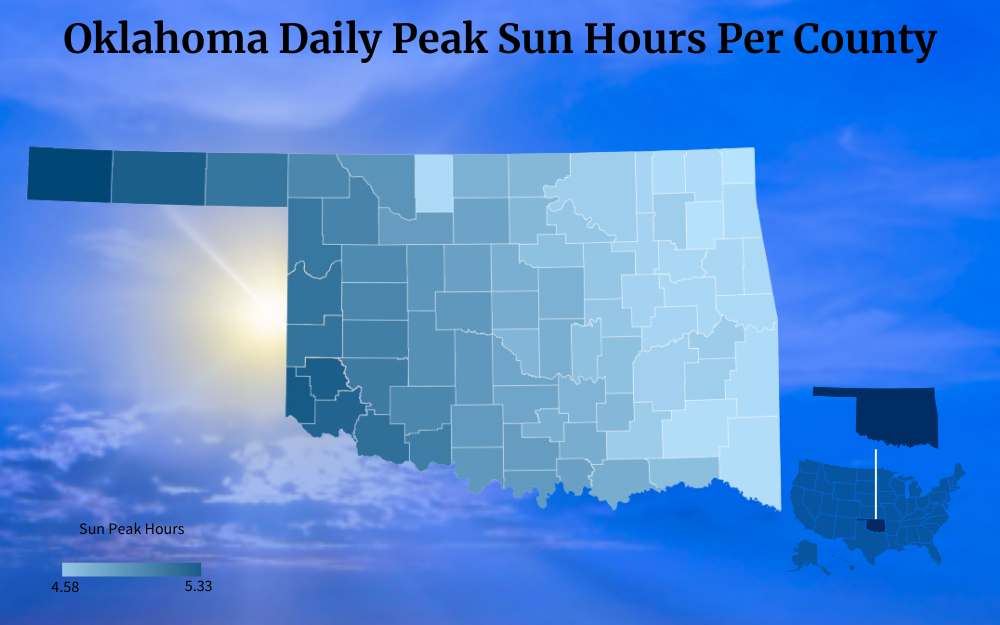

With 234 average sunny days in a year, even higher than the national average, sunlight exposure will not really be an issue when installing your solar panels in Oklahoma.

And, thanks to a number of solar credits, renewable energy programs and rebates, and other state and local initiatives, it’s easier than ever to go solar.

This guide outlines available Oklahoma solar incentives and explains registration and enrollment processes for reducing the cost of your residential solar energy system, and ultimately, your electricity bill.

Solar Credits That Apply in Oklahoma

Solar panels in Oklahoma are gaining more and more traction by the day, and it is now common to find panels on people’s roofs and properties.

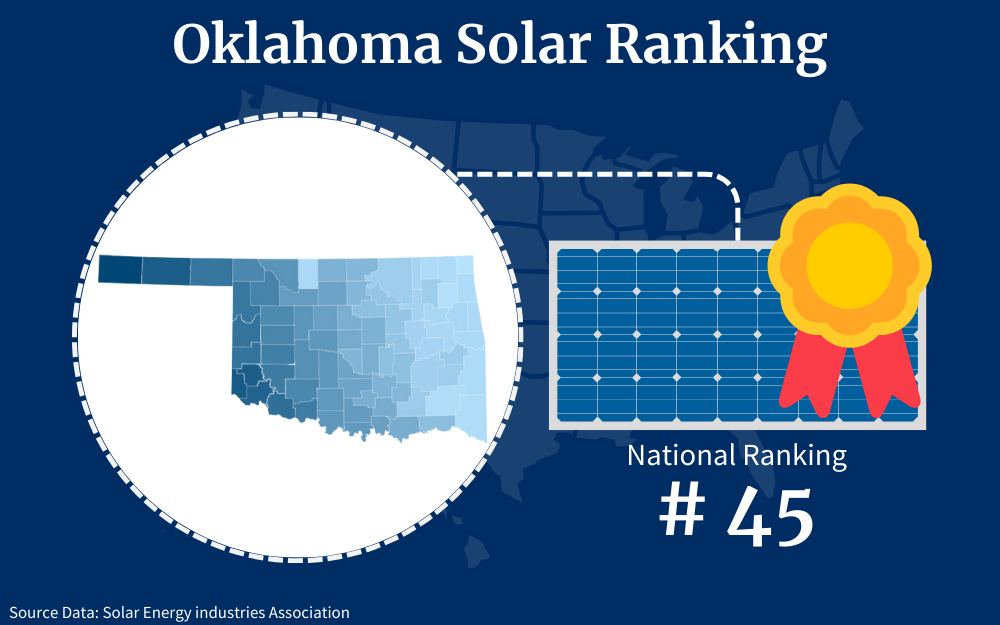

Even though the state doesn’t rank that high when it comes to solar adoption, the massive improvement over the years cannot possibly go unnoticed. At number 45 in the entire country and with a massive step to take to reach the top, it is still incredible that there are more than 14,000 homes that have made the conversion to solar power.3

This is despite the state lacking a strong Renewable Portfolio Standard (RPS) and not having an SREC (Solar Renewable Energy Certificate) market. But still, there is a lot happening in favor of the adoption of renewable energy.

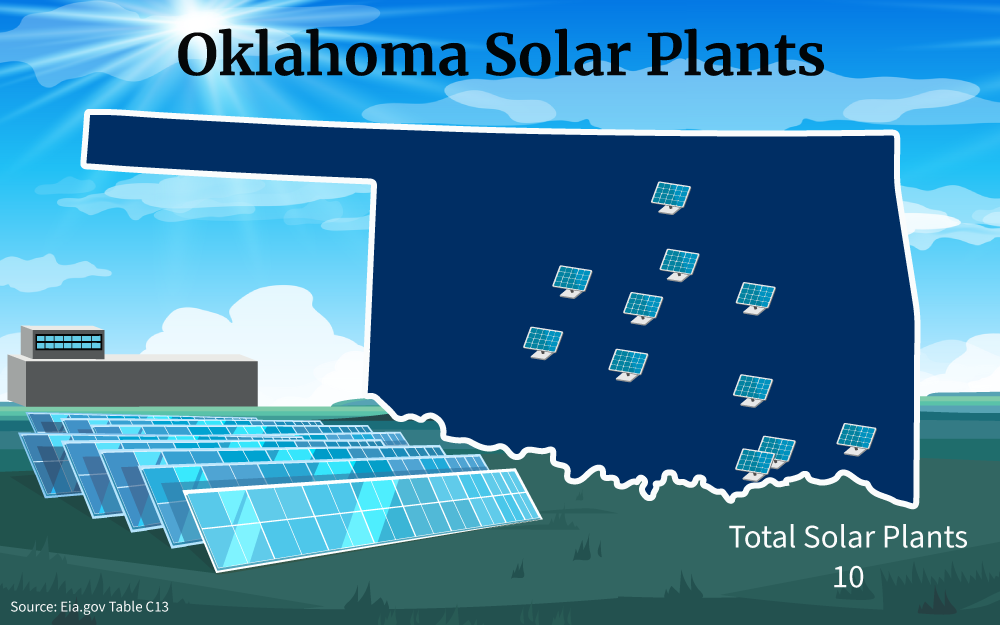

Did you know that there are more than 30 solar companies in the area and that there has been more than $200M invested in the industry by the state? All these go to show that there is a lot of potential in regards to solar in the state.

Besides, the SEIA projects that there should be at least 2,000 MW of installations in the next half a decade. You can easily tell that Oklahoma is making strides in the right direction and may just be one of the most notable in the future.

What prevents more people from embracing Oklahoma solar power is the notion that it is too expensive. This is no longer an excuse.

There are now local incentives and solar tax credits that help reduce the total cost to solar panel a house, and it is common to find yourself saving thousands of dollars. There has been a positive influence in the market over the last decade, and you want to take advantage of these new programs.

ITC Tax Credit Options

When you take a closer look at the state of the solar market in Oklahoma, it is easy to see that there has not been that much happening in regard to rebate programs. That is at least since the year 2015, when the RPS,8 unfortunately, came to an end; it is still yet to be renewed, which means that there are not very many Oklahoma solar incentives available.

However, there are some local incentives that you can make use of, even if you miss out on the tax credit.

OEC Incentives

If you are a loyal customer of Oklahoma Electric Cooperative, you will be thrilled to know that there are cash-back incentives that are up for grabs. You will be eligible just as long as you have installed any energy-efficient system in your home; it could be a water heater or a heat pump.15

Edmond Electric Incentive

Again, customers of the Edmond Electric company are able to receive Oklahoma solar rebates as long as they have made any energy-efficient upgrades like insulation and heat pumps.14

WISE Rebate Program From OMPA

If you are a customer of the Oklahoma Municipal Power Authority, then you will be glad to know that you are eligible for the Ways I Save Electricity Oklahoma solar program, which basically offers cash-backs if you install any renewable energy equipment in your home.13

PSO Program

There is more for the residents of Oklahoma because the Public Service Company of Oklahoma has got so many cash-back programs for anyone who is buying new energy-efficient pieces of equipment,12 whether HVAC or insulation.

Net Metering Explained

You must have heard about net metering as one of the solar incentives that are provided by states. But what is it all about?

You may find it rather confusing, but in reality, it is quite a simple program that helps a lot when it comes to saving you money in the long run. What is net metering really?

NEM is an incentive that is offered by the state, allowing solar Oklahoma system owners to tie to the grid, supplying excessive power to the line while receiving credits in return.1

When you get the power back for your own consumption, you will be able to use the credits that you have received as payment. So, technically, you could get power from the grid at absolutely no cost.

The credits come in every single month, and you will enjoy a power supply even at night when your panels are not producing any power.

Do solar panels work on cloudy days? They do, but if there is weather interference reducing their efficiency, you would be safer drawing power from the grid which you can pay for using your credits.

You will realize that the more power coming from your panels, the more you are going to save in terms of electric bills.

Thanks to the Oklahoma Corporation Commission, the institution that regulates the cost of energy and the rates of net metering, all utility companies in the region that are investor-owned are mandated to provide net metering for their customers. But there is one problem.

There are no specific rules about just how many credits you are able to receive based on the amount of energy that you produce.

The net metering Oklahoma rates usually vary according to the company and where you live, and that is why there are very high chances that you could get unfavorable rates.9 The price may not be the full retail rate that other states offer, and there are instances where you will be required to actually pay a fee when enrolling for the program.

How To Qualify for Oklahoma Solar Rebates and Credits

You have already heard about the Oklahoma solar tax credit but very little about how it really works and how it is supposed to make solar more accessible for you.

The solar panel tax credit is one of the most thoughtful and highly acclaimed solar incentives in Oklahoma, no, in the entire country. It first came to the scene in the year 2005, until its extension, all thanks to the Inflation Reduction Act of 2022.

So, how does it work?

The tax credit, just as the name suggests, is an incentive that works by reducing the amount of taxes that you owe just for installing solar panels in Oklahoma.

Basically, it is set at 30% of the total installation cost. Here is what happens: if you use $1,000 when installing your panels, you are eligible for a $300 tax credit from the government, and this comes in the form of paying less taxes by $300 in this case.

It is a very simple mode of operation that has worked over the many years since its creation.

Undoubtedly, it is one of the most attractive solar incentives in the region, and that explains why you would want to pay a lot more attention to it. But that cannot happen if you don’t pass the eligibility criteria.

You would want to know how to qualify for the tax break because otherwise, you will be locked out of it.

First and foremost, know that the solar tax credit only works for those residents who have already installed their systems; you cannot apply for it until you have completed the entire project.7

Secondly, the ITC is designed in such a way that it is exclusively for the taxpayers.

Wondering how the solar tax credit works if I don’t owe taxes. That would be tricky because how will you get a reduction on a liability that you don’t have?

So, people who don’t pay taxes or those without a tax liability are not eligible. You should also note that during the review process, the IRS has to confirm that you are indeed the owner of the panels.

The system must belong to you and be in your name because that way, the credit will be going to the right person. Needless to say, you can only apply when you are dealing with a brand-new installation; the materials should come straight from the solar company, and you will see how there is a lot of emphasis on the company’s details when you are applying.

How To Apply for Federal Solar Tax Credit

Imagine saving as much as $8,600 on a system that costs you $28,800 to have installed. That is a pretty huge deal, and it explains why you are interested in learning how to apply for the solar tax credit in Oklahoma.

The good news is that it is a process that will take only a few minutes of your time, and you should be on your way to receiving thousands in tax breaks.

So, how exactly do you apply for a federal solar tax credit?

Step 1. Download the IRS Form 5695.11 This document is specifically to help people claim credits as long as they have installed energy-efficient systems in their homes.

Step 2. There are certain Form 5695 instructions that need to be followed to the latter.5 The document will ask you for specific details like how big your system really is, how much money you spent when having it installed, which company you contracted for the job and many more specific details about your project. If you don’t have some information, you can always ask the solar company to help.

Step 3. When you are certain that you have disclosed all the necessary details, the last step is to file the document together with your taxes. Make sure that you enter only the correct details to guarantee your chances of receiving the incentive.

The IRS will receive your application, review it, and determine whether you are eligible for it, and will then credit your account accordingly.

How To Calculate How Many Solar Panels You Need

Why should you calculate how many panels you need? Do you really have to use a solar savings calculator?

These are some of the most common questions from first-time solar owners, wondering what is the point of turning to online software to figure out the numbers. You need solar calculators for so many things if you are a newbie planning to make the switch.

For one, knowing how many panels you need will help you estimate how much you are going to spend, and it is one way to tell whether your roof space will be sufficient or you will have to seek alternative mounting methods. On the other hand, a solar savings calculator will come in handy to motivate you because it tells you just about how much you are going to save when you fully convert to solar power of Oklahoma.

The NREL solar calculator, like other software, offers very simple ways for you to estimate how much power will come from your solar system. This way, whether you are a homeowner, a solar installer, or a manufacturer, you will know the performance level of PV systems.

You can easily tell how many panels you are going to need based on your energy needs and the performance of a single panel. The more the power, the more the panels you are going to need.

This will help you when budgeting, and it is great news if you have a small household and don’t need that many panels.

As for the energy needs, you can easily estimate that by taking your previous monthly bills and finding the average. That should tell you how big your system is going to be.

Home Solar Installation Expenses and Materials

The Oklahoma solar energy system is slowly becoming a necessity, more so now when the electric bills keep soaring. Something has to be done, and home solar panels are an excellent idea because not only do they help reduce these costs significantly, but they are also ideal for the environment.6

But before you decide to convert, there are certain things that you need to know, starting with the materials that make up the entire system.

Looking at the whole installation, you will be awed by just how much goes into making the solar system what it is. It is an elaborate process from the transformation of the sun’s rays to power that can run your home.

What is the solar process that results in the production of energy?

It is called nuclear fusion, a high-energy process that occurs in the sun to create very powerful amounts of energy. To harness this power, you will need solar panels, which are one of the most crucial parts of the system.

Apart from that, the charge controller will also come in handy because how else will the excess power be managed?

After that, the solar inverters come in to convert DC to AC, and finally, the batteries will be needed to help store the excess power.

Looking at how detailed the system truly is it leads to the question, what is the cost of solar panels in Oklahoma? Well, the average cost of solar panels in Oklahoma ranges between $20,900 – $26,200 that is for systems of 8 kW to 10 kW.4

You can expect to pay anything in that range or even lower depending on just how much energy you need, the type of panels that you go for, and so many other factors. But all in all, the solar tax credit will step in to reduce the home solar power cost for you.

Besides, you can also learn how to make a solar panel on your own using very simple materials and in very few steps and this will save you a lot of money.

Where To Buy Solar Panels in Oklahoma

USA solar panels come in various types and each brand makes sure that their products stand out from the rest.

This can be a challenge for you if you are installing a system for the very first time. Which brand should you go for; will it be worth the solar install cost?

It can be pretty overwhelming to settle for just one solar manufacturer, but if you do it carefully, you will be lucky to find highly effective panels at a competitive price.

So, where do you even start?

Take suggestions from your neighbors, friends, and family. Ask them who got their panels installed, then narrow it all down to just a few of them.

You can also confirm from the customer reviews and watch out for any red flags.2 If you have shortlisted and married it down to just a few, the next step is basically to get to the groundwork.

Find the quotations from these companies and make your own comparisons. Apart from the pricing, you also want to look for the company’s professionalism when it comes to communication and other aspects to make sure that you are dealing with a group of people who know what they are doing.

A highly experienced company that has been in the game for at least two years will make a really great option.

Lastly, you should be very careful when looking for a company because you will more often than not come across the selling of “free solar.” As enticing as it may sound, these are only Power Purchase Agreements,10 not free solar panels in Oklahoma.

Getting into it, you will realize that you will still end up paying for the power that the panels are able to produce, which means that the system is not absolutely free.

Why Go Solar in Oklahoma?

The solar panels used in Oklahoma go a pretty long way to ease the pressure on traditional grid systems, and, at the same time, lower the over-reliance on fossil fuels. Wondering why are solar panels good for the environment?

You should probably know that the level of emissions from panels is nothing in comparison to the effect that fossil fuels have on the planet.

This answers your question: Are solar panels worth it in Oklahoma? Apart from that, also think about the high energy needs of the people and how much an alternative power source is going to save a lot of money in the long run.

No more being tied to the grid and paying hefty electric bills at the end of the month. While there are so many upsides to going solar, you can’t help but think, are solar panels bad for the environment?

The only issue when it comes to the use of solar panels is the fact that the old decommissioned equipment can end up in landfills. Why is solar energy bad? You may ask.

The chemicals used in the panels can cause pollution and that is perhaps why there is a lot of emphasis on the recycling of old panels and the selling of surplus solar panels.

Oklahoma has the advantage of heavy sunlight exposure, and this is perfect for installing solar panels in the region. But that is not all; there is also the federal solar tax credit and other local incentives that go a pretty long way to help reduce the cost of installation, so again, the price point should not be a problem.

Hopefully, this article has expounded more on the tax credit and other Oklahoma government solar incentives to convince you to go solar.

You must have noticed how effortless it is to apply for the tax credit and how there are very simple rules to follow in the solar tax credit forms in Oklahoma to make sure that you are eligible.

Given that the tax credit rate is currently at its peak, this is an optimal moment to transition to solar, leveraging the Oklahoma solar incentives.

Frequently Asked Questions About Oklahoma Solar Incentives

What Forms Do I Need for Solar Tax Credit?

There is one crucial form that you absolutely need when applying for a solar tax credit in Oklahoma, and that is the IRS Form 5695, which you will have to download from the government website, fill it, and file it when doing your taxes.

Does Oklahoma Offer SRECs?

Unfortunately, unlike what happens in some other states, there is currently no SREC market in Oklahoma. So, even as a solar system owner, there is absolutely no way for you to receive any credits for the power you produce or even sell it for a profit.

Does Oklahoma Have Sales and Property Tax Exemptions?

Oklahoma also doesn’t have any tax exemptions that come with installing solar panels for home Oklahoma. Lacking these two means that you cannot get a reduction when buying the equipment, and since they increase the value of your property, you may have to pay additional taxes after the installation.

References

1Berdikeeva, S. (2023, August 29). Oklahoma Solar Incentives: Tax Credits & Rebates 2023. SaveOnEnergy.com. Retrieved August 31, 2023, from <https://www.saveonenergy.com/solar-energy/Oklahoma/>

25 Best Solar Companies in Oklahoma (2023 Guide). (2023, June 29). This Old House. Retrieved August 31, 2023, from <https://www.thisoldhouse.com/solar-alternative-energy/reviews/best-solar-companies-Oklahoma>

3Matthews, L. (2022, November 11). Oklahoma Solar Incentives & Tax Credits for 2023. LeafScore. Retrieved August 31, 2023, from <https://www.leafscore.com/solar-guide/benefits-of-going-solar/solar-rebates-and-incentives/Oklahoma-solar-incentives/>

4Neumeister, K. (2023, August 5). How Much Do Solar Panels Cost in Oklahoma? (2023 Savings Guide). EcoWatch. Retrieved August 31, 2023, from <https://www.ecowatch.com/solar/panel-cost/ok>

5Internal Revenue Service. (2023). Instructions for Form 5695. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/i5695.pdf>

6U.S. Energy Information Administration. (2022, February 25). Solar explained | Solar energy and the environment. EIA. Retrieved August 31, 2023, from <https://www.eia.gov/energyexplained/solar/solar-energy-and-the-environment.php>

7Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office of Energy Efficiency & Renewable Energy. Retrieved August 31, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

8Rader, N., & Hempling, S. (2001, February). The Renewables Portfolio Standard | A Practical Guide. Energy.gov. Retrieved August 31, 2023, from <https://www.energy.gov/oe/articles/renewables-portfolio-standard-renewables-portfolio-standard>

9State of Oklahoma. (2021, April 2). Net Metering in Oklahoma. Oklahoma Corporation Commission. Retrieved August 31, 2023, from <https://oklahoma.gov/occ/divisions/public-utility/electric-utility/netmetering.html>

10U.S. Department of Energy. (2023). Power Purchase Agreement. Better Buildings | U.S. Department of Energy. Retrieved August 31, 2023, from <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement>

11Internal Revenue Service. (2022, December 6). Residential Energy Credits [PDF Form]. IRS. Retrieved August 31, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

12Power Forward with PSO. (2023). Rebates. Public Service Company of Oklahoma. Retrieved September 14, 2023, from <https://powerforwardwithpso.com/rebates/>

13Oklahoma Municipal Power Authority. (2023). Rebate Program. Oklahoma Municipal Power Authority. Retrieved September 15, 2023, from <https://www.ompa.com/services/rebate-programs/>

14Edmond Electric. (2023). Rebate & Program. Edmond, Oklahoma. Retrieved September 15, 2023, from <https://www.edmondok.gov/1271/Rebates-Programs>

15Oklahoma Electric Cooperative. (2021). Energy Efficiency Rebates. Retrieved September 15, 2023, from <https://okcoop.org/energy-efficiency-rebates/>

16Photo by The City of Oklahoma City. OKC.gov. Retrieved from <https://www.okc.gov/departments/planning/programs/sustainability/incentives-tax-credits>

17Photo by D Cannon. Pixabay. Retrieved from <https://pixabay.com/photos/solar-farm-solar-energy-4443338/>